Getting a complete view of our financial data across all the different systems was very challenging. It took a long time to close the books, requiring heavy manual effort from our accounting and supply chain teams. Before Whitespectre, we didn’t have the support or technical expertise we needed to fully implement automated data integration.

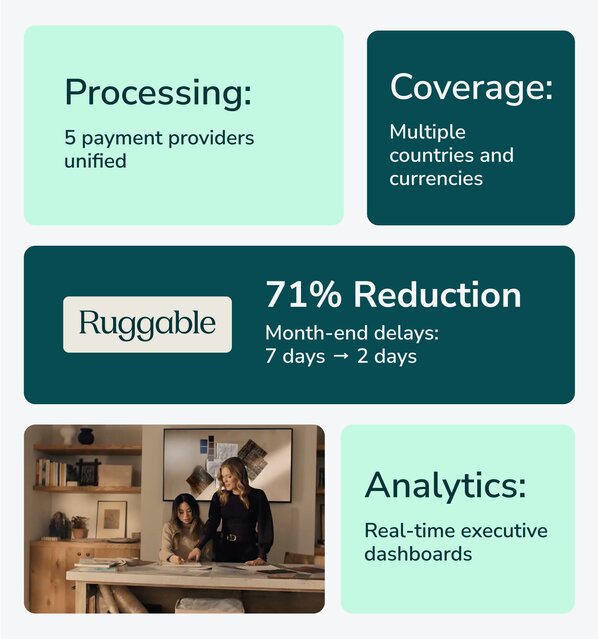

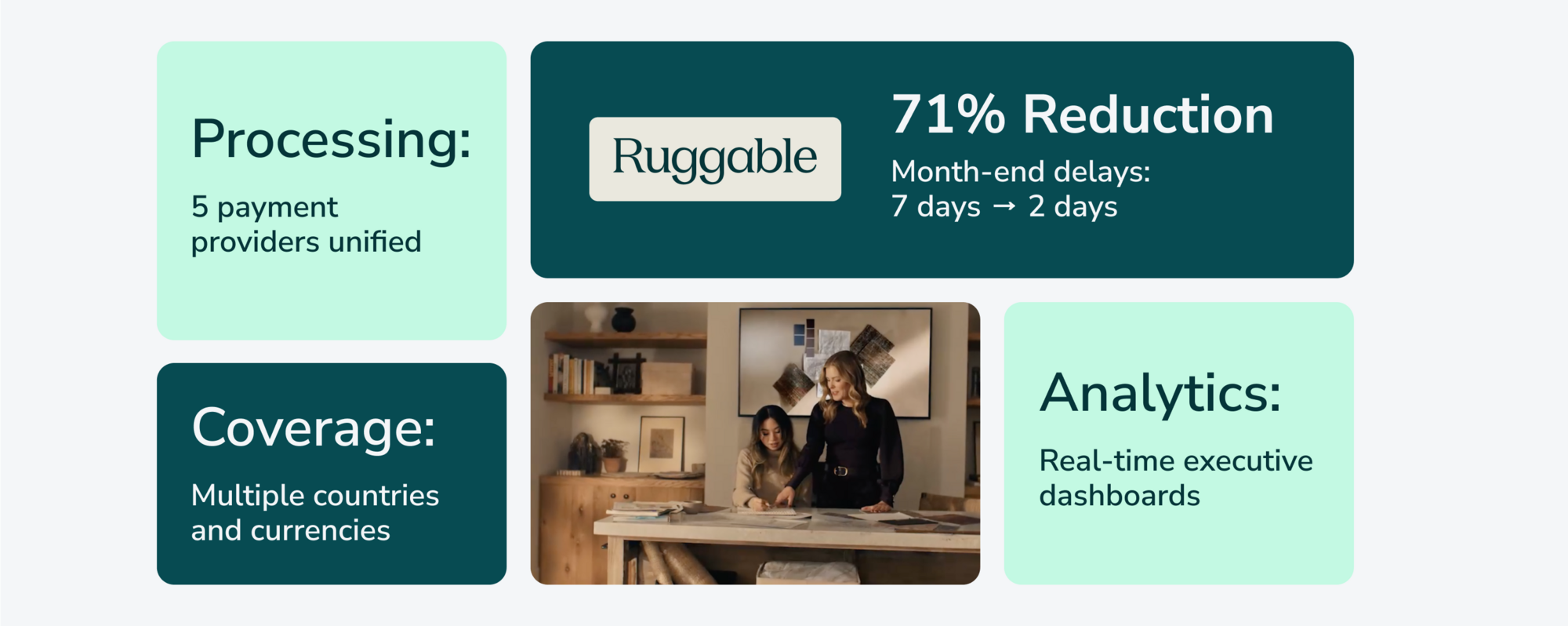

We helped transform Ruggable's fragmented financial data ecosystem into a unified, scalable, AI-ready architecture. Automated reconciliation and pipelines reduced month-end close by 71% while laying the foundation for ML-driven analytics.

SERVICES

Data Engineering

Product Management

TECHNOLOGY

Apache Airflow

Apache Spark

Python

AWS Redshift

Snowflake

Oracle

CLIENT

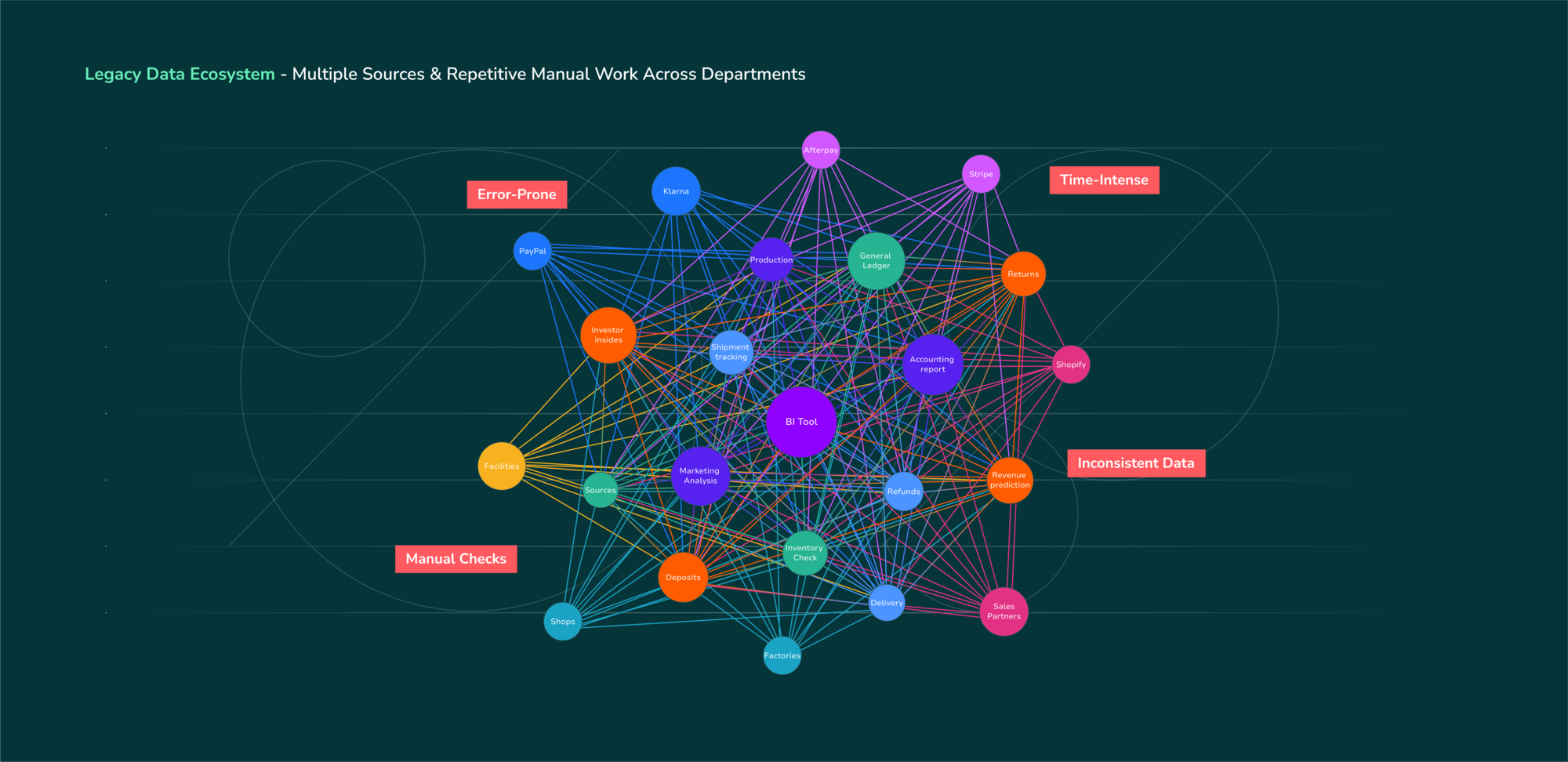

The Challenge: Disconnected Global Data and Delayed Insight

Ruggable revolutionized the home goods market with their patented machine-washable rug system. As the company scaled internationally- across multiple regions, production facilities, and retail channels- its finance and operations data grew equally complex.

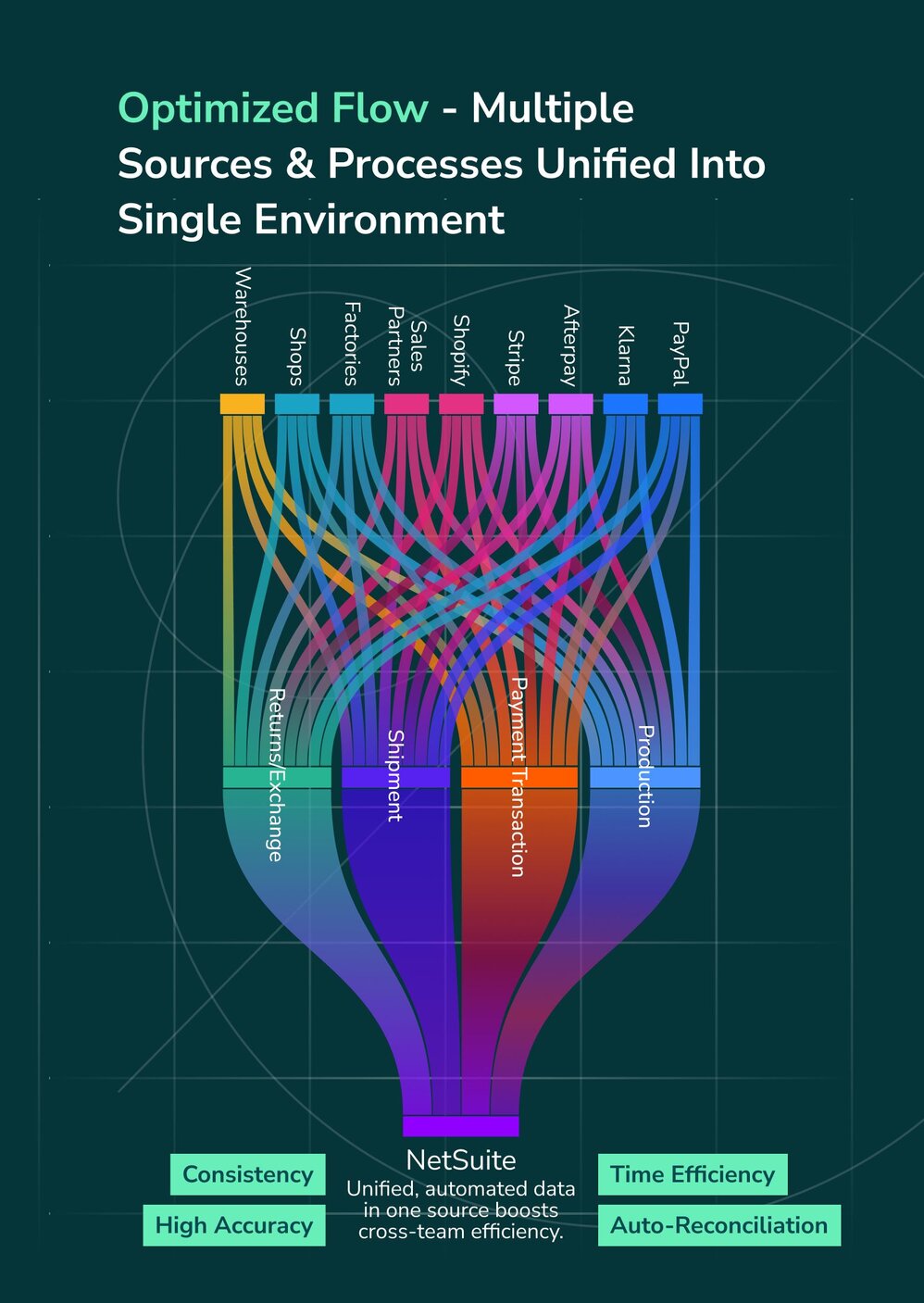

Their accounting team now faced significant bottlenecks, needing to wait at least a week after period close before beginning general ledger work. Financial data had become fragmented with the rise of their global footprint:

- Five e-commerce sites (US, UK, AU, EU, Germany)

- Six major retail partners (Amazon, The Home Depot, Costco, John Lewis, Lowe's, Target)

- Seven+ global production facilities

- Five payment service providers (PayPal, Klarna, Afterpay, Stripe, and Shopify)

- Shipment tracking and returns

- Refund and deposit workflows

Each data source had its own structure, currency logic, and transaction status definitions. This led to a heavily manual reconciliation process, inconsistent reporting, and limited executive visibility into real-time performance across their international operations.

The Challenge: Fragmented Financial Data Across Operations

Ruggable operates a complex global business with multiple production facilities and subsidiaries across different countries. The accounting team faced a month-end bottleneck, waiting at least one week after period close before they could begin their general ledger work.

Financial information was scattered across multiple data sources: five different payment service providers (PayPal, Klarna, Afterpay, Stripe, Shopify, and Amazon), production systems, shipment tracking, returns processing, and deposit and refund workflows.

Each source had different data structures, transaction naming conventions, and status definitions, making reconciliation a manual, time-intensive process that limited executives' access to timely financial insights.

Our Approach: Architecture-First Thinking

Our dedicated data engineering team worked closely with Ruggable's analytics group to tackle this complex integration challenge.

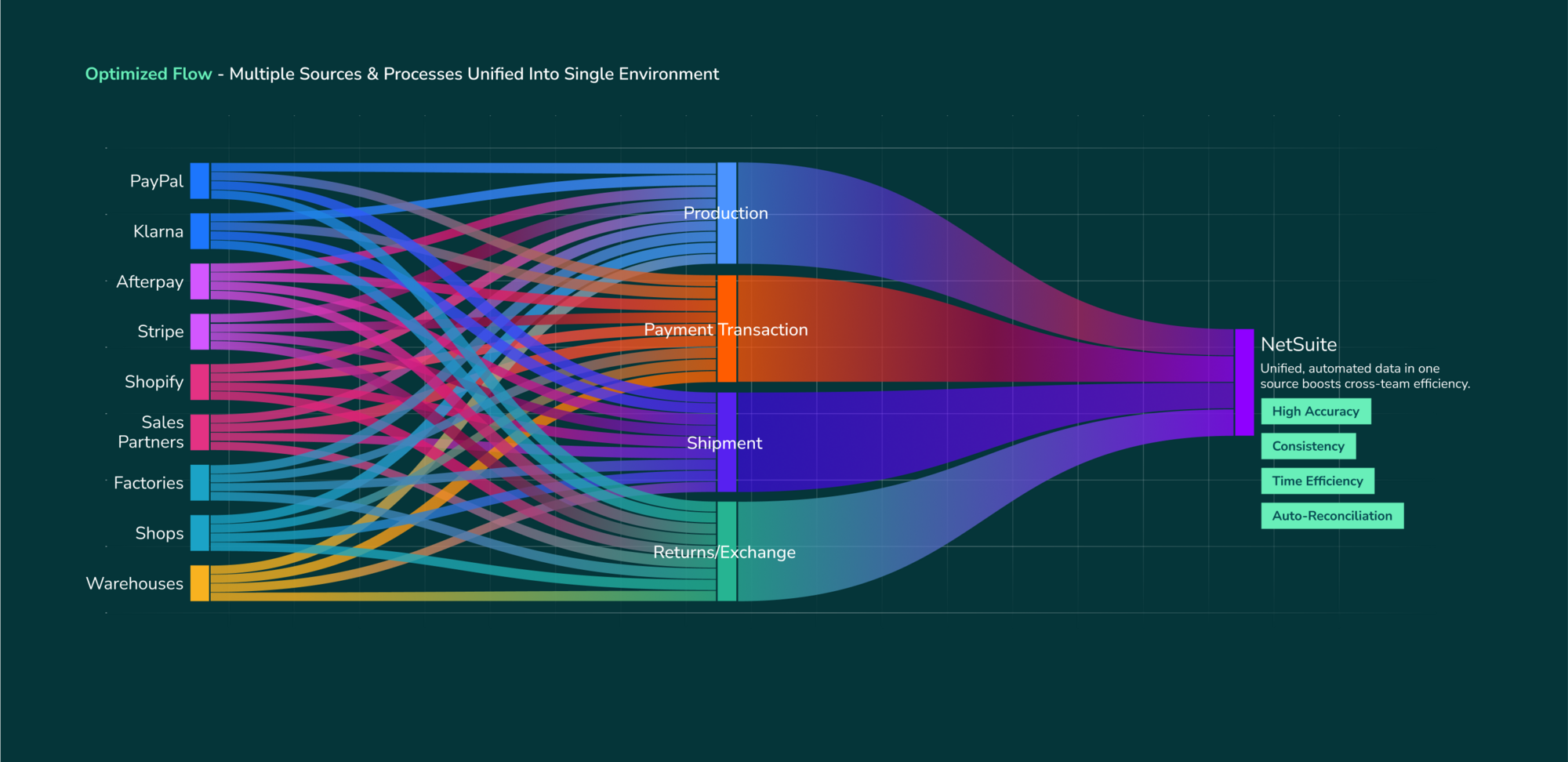

Initial scoping explored custom NetSuite integrations. But we quickly identified technical limitations that would make the solution fragile and hard to scale. Instead, we used MHI’s platform—purpose-built for NetSuite—and focused on designing a data architecture that could scale with Ruggable’s business and analytics needs.

The Solution: A Unified, Scalable Data Infrastructure Ready for AI

Payment Data Unification

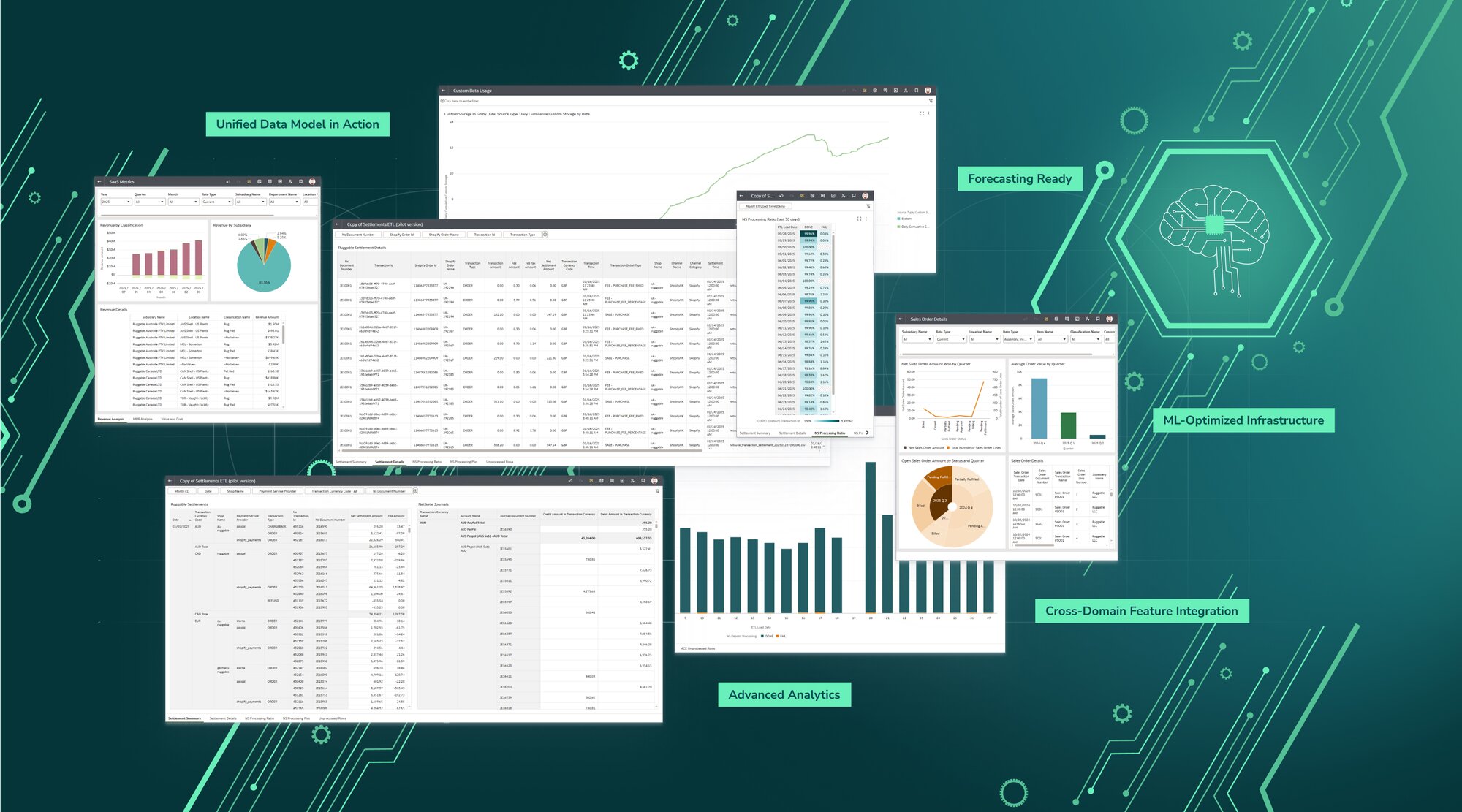

We became subject matter experts on five major PSPs, each with its own schema and naming logic. We standardized and reconciled transaction data to deliver complete, dollar-accurate reporting across all sources—eliminating manual accounting workarounds.

Multi-Source Data Pipelines

Using DBT, Apache Airflow, and Apache Spark, we built scalable pipelines across production systems, returns, and partner channels. These pipelines processed high-volume, multi-currency data, enabling end-to-end traceability and efficient batch orchestration.

Automated Reconciliation

Manual, spreadsheet-based reconciliation was replaced with automated validation and consolidation. We implemented robust data checks and exception handling using AWS Redshift and Snowflake, allowing accounting teams to trust the data and focus on analysis, not triage.

Strategic Impact: Faster Close, Real-Time Insights, AI Foundation

71% Faster Month-End Close

Ruggable reduced their post-close delay from 7 days to 2, unlocking faster financial reporting and more responsive operational decision-making.

Real-Time Executive Visibility

Executives now have fast access to consolidated financial and operational data—enabling agile planning, performance tracking, and revenue monitoring across countries and business units.

Single Source of Truth

All payment and operational data is now reconciled, governed, and integrated into one source of truth—supporting consistent reporting and collaboration across teams.

Enablement for Advanced Analytics

With structured, high-granularity data available, Ruggable can now run complex analyses—connecting promotional spend to revenue outcomes, modeling product-level profitability, and tracking full-funnel customer journeys.

The collaboration with Whitespectre was very successful because they acted as a self-sufficient engineering and product pod. We had design and refinement conversations, but their leads made strong technical decisions and guided the architecture. That gave us confidence that the output was technically sound. Now, having this single source of truth has completely changed how our internal teams operate.

AI Readiness: Laying the Groundwork for Predictive Intelligence

This project didn’t just solve for month-end reporting—it established the core building blocks for Ruggable’s long-term data and AI strategy. By delivering clean, governed, and extensible datasets, we’ve made possible:

Predictive Modeling Opportunities

The unified transaction and returns data provides ideal inputs for future ML models—like revenue forecasting, churn prediction, or fraud detection.

Cross-Domain Feature Generation

By integrating data across payments, production, returns, and logistics, Ruggable can now build complex behavioral datasets that support segmentation, LTV modeling, and journey analytics.

Common Data Model Evolution

The architecture we implemented became the backbone for a broader data initiative—Ruggable’s emerging enterprise-wide common data model. This expands analytics capabilities beyond accounting to product, growth, and executive strategy.

The AI and machine learning use cases we’re most excited about center on financial forecasting. Our models have always been very manual, but with the foundation we’ve built with Whitespectre, we now have the ability to explore predictive modeling at scale. The work they did set a great example, one we’ll continue to champion.

Results at a Glance

- Month-end delay: Reduced from 7 days to 2 (71% faster)

- Global scope: 5 main subsidiaries, 6+ retail partners, 7+ facilities

- PSPs unified: PayPal, Klarna, Afterpay, Stripe, and Shopify

- Geography: Multi-currency, multi-country support

- Data Stack: Airflow, Spark, Redshift, Snowflake, DBT, Oracle, NetSuite

- AI Enablement: Clean, governed, ML-ready data sets in place

Results at a Glance

- Month-end delay: Reduced from 7 days to 2 (71% faster)

- Global scope: 5 main subsidiaries, 6+ retail partners, 7+ facilities

- PSPs unified: PayPal, Klarna, Afterpay, Stripe, and Shopify

- Geography: Multi-currency, multi-country support

- Data Stack: Airflow, Spark, Redshift, Snowflake, DBT, Oracle, NetSuite

- AI Enablement: Clean, governed, ML-ready data sets in place

Looking Ahead

Ruggable’s leadership now operates with confidence in their data—and with a foundation that supports long-term strategy. As their common data model evolves, they’re positioned to expand ML experimentation, improve forecasting accuracy, and unlock data-driven decision-making at scale.